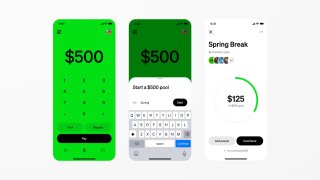

- Block-owned payments platform Cash App launched a new peer-to-peer platform called Pools.

- Pools lets users take group payments via Cash App, Apple Pay, or Google Pay.

- PayPal s Venmo continues to gain ground, reporting more than 20% year-over-year revenue growth in Q2, driven by higher debit card use, instant transfers, and online checkout integrations.

Peer-to-peer payments are being aggressively pursued by Cash Appis.

With NBC 7, you can watch San Diego News for free, anywhere, at any time.

Pools, a new peer-to-peer feature created to simplify group payments, was introduced on Tuesday by the Block-owned payments platform. The company hasn’t released a significant P2P product in almost two years.

Block’s head of business, Owen Jennings, stated, “This is the first time we’re going into out-of-network payments with Pools,” alluding to the feature’s capacity to receive donations from non-Cash App users via Apple Pay or Google Pay.

With our News Headlines email, you can receive the best local San Diego stories every morning.

Whether splitting a restaurant bill or raising money for a group outing, pools enable users to establish and maintain a pooled balance for group payments. Contributions can be made through the Cash App, Apple Pay, or Google Pay, which allows users who have never used the app before to participate.

Organizers can facilitate out-of-network involvement by posting a Pool link, which allows them to collect money from friends who do not utilize Cash App.

The debut coincides with Cash App’s desperate attempt to reclaim ground in a fierce competition with Venmo, which has been expanding steadily under new management at PayPal.

Money Report

Senate introduces bill for tariff rebate checks after Trump suggestion

JPMorgan Chase is nearing a deal to replace Goldman Sachs as Apple Card issuer, sources say

-

Tesla plans ‘friends and family’ car service in California, regulator says

-

Palantir joins list of 20 most valuable U.S. companies, with stock more than doubling in 2025

-

Meta names OpenAI’s Shengjia Zhao as chief scientist of AI Superintelligence Lab

-

Inside Tesla’s new retro-futuristic Supercharger diner

Prior to Tuesday’s market opening, PayPal released its second-quarter earnings.With sales rising more than 20% year over year—its greatest growth rate since 2023—Venmo had another outstanding quarter.

This came after an equally impressive first quarter in which Venmo’s revenue growth twice the rate of payment volume due to the growing use of online checkout, immediate transfers, and debit cards. Increased usage of Venmo debit cards, fast transfers, and online checkout connections drove the improvements. Venmo revenue is not broken out by PayPal.

Pools’s debut represents a strategic reset for Block. In May, the business revealed poor first-quarter results, falling short of sales projections and acknowledging that it had lost focus on expanding Cash App’s user base.

According to Jennings, “Money is fundamentally social in nature,”

“We want Cash App to be the financial operating system for the next generation, essentially being the money app where a customer can run their entire financial life,” Jennings, the former chief operating officer of Cash App, was added.

A key component of Cash App’s larger growth plan is reinvesting in the peer-to-peer features that initially made the app popular with the goal of making them more accessible and social.

Giving consumers access to Google and Apple accounts is a chance to increase user activity and attract new users to the ecosystem, according to Jennings.

Every non-user who adds to a pool is viewed by the business as a possible convert.

“This product is fundamentally geared at network expansion and improving the virality of our peer-to-peer products,” he stated. “It’s the foundation of Cash App it’s how Cash App started, but it’s also the growth engine that fuels everything else.”

Internally, Block’s culture has changed as a result of the deployment. With the help of internal AI technologies like Goose, the company’s open-source assistant, and what Jennings called “high velocity, high quality” development, the product went from concept to debut in a matter of months.

“The pace of development on this and our ability to get it in customers’ hands feels really different this year,” Jennings stated. “Especially in the past three or four months, relative to how things felt about a year ago.”

“The shift isn’t exclusive to Block,” he continued.

As the marginal cost of a fantastic line of code continues to decline, you’ll likely observe it in the industry, where development will accelerate. And this is just a fantastic illustration of how quickly we were able to move.”

CEO Jack Dorsey’s request to bring Cash App back to its primary growth engine is also reflected in the launch. The platform’s recent poor performance was acknowledged by Dorsey during the company’s first-quarter earnings call.

“I just don’t think we were focused enough and had enough attention on the network and the network density, and that is our foundation,” he stated.

Dorsey underlined that peer-to-peer interaction remains crucial to Cash App’s success even as it expands its banking and lending offerings, such as its FDIC-approved Borrow program.

“We of course want to deepen engagement with our customers through banking services and Borrow,” he stated. “But at the same time, we need to make sure that we continuously grow our network, and that starts with peer-to-peer.”

The purpose of pools is to promote natural user development rather than direct income.

“We’re not looking at this from a profit maximization perspective,” Jennings stated. “This is very geared at network expansion and getting back to a place where actives are growing at a healthy clip.”

Organizers can set a goal amount and distribute a link to gather donations, and the tool has integrated progress tracking and easy integration with Cash App’s banking features.

Only a select group of Cash App customers may now access Pools; a wider deployment is anticipated in the upcoming months.According to Jennings, it marks the beginning of a new chapter for Block, one that is centered on making money seem “more multiplayer.”

WATCH: As MasterCard connects its global payments network to Fiserv’s new stablecoin, its stock soars.

Also on CNBC

-

Apple opens manufacturing academy in Detroit as Trump ramps up pressure on company

-

Meta’s AI spending spree is Wall Street’s focus in second-quarter earnings

-

How the U.S. is countering China s rare earths trade war bargaining chip